“New Norfolk Dual-Villa Investment - $46,800 Income, 7.2% Yield, 2 x 2-Bed Villas”

Property analysis by:

Investment Highlights

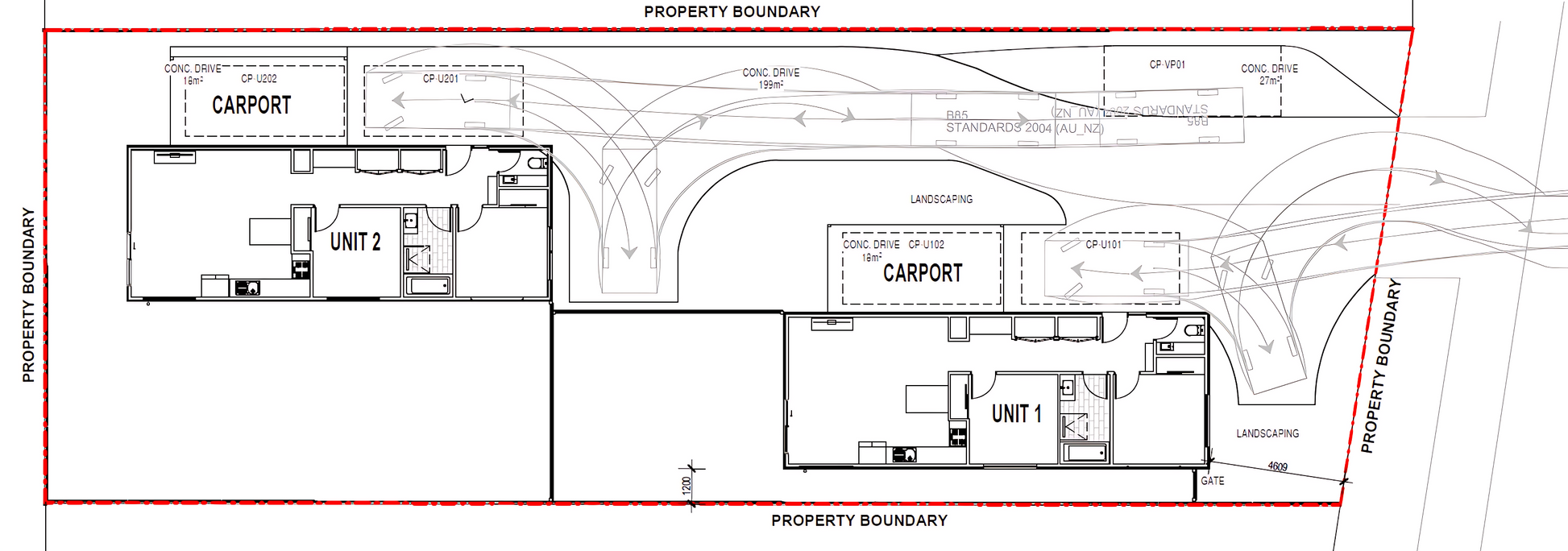

- Priced at $650,000 for a dual-villa package configured as 2 x 2-bed, 1-bath, 1-carport villas on one title.

- Rental guidance $900 per week combined across both villas, or $46,800 p.a. at current settings.

- Gross yield 7.2% on the package price, targeting strong cash flow in a stable rental market near Hobart.

- Turnkey delivery with modern inclusions, separate living zones, study nooks, carports and additional off-street parking.

- Hobart adjacency about 35 minutes to the CBD via Lyell Highway. Riverside lifestyle and community amenities support durable tenant demand.

Key Financials

Property package price: $650,000 (Land $200,000 + Build $450,000)

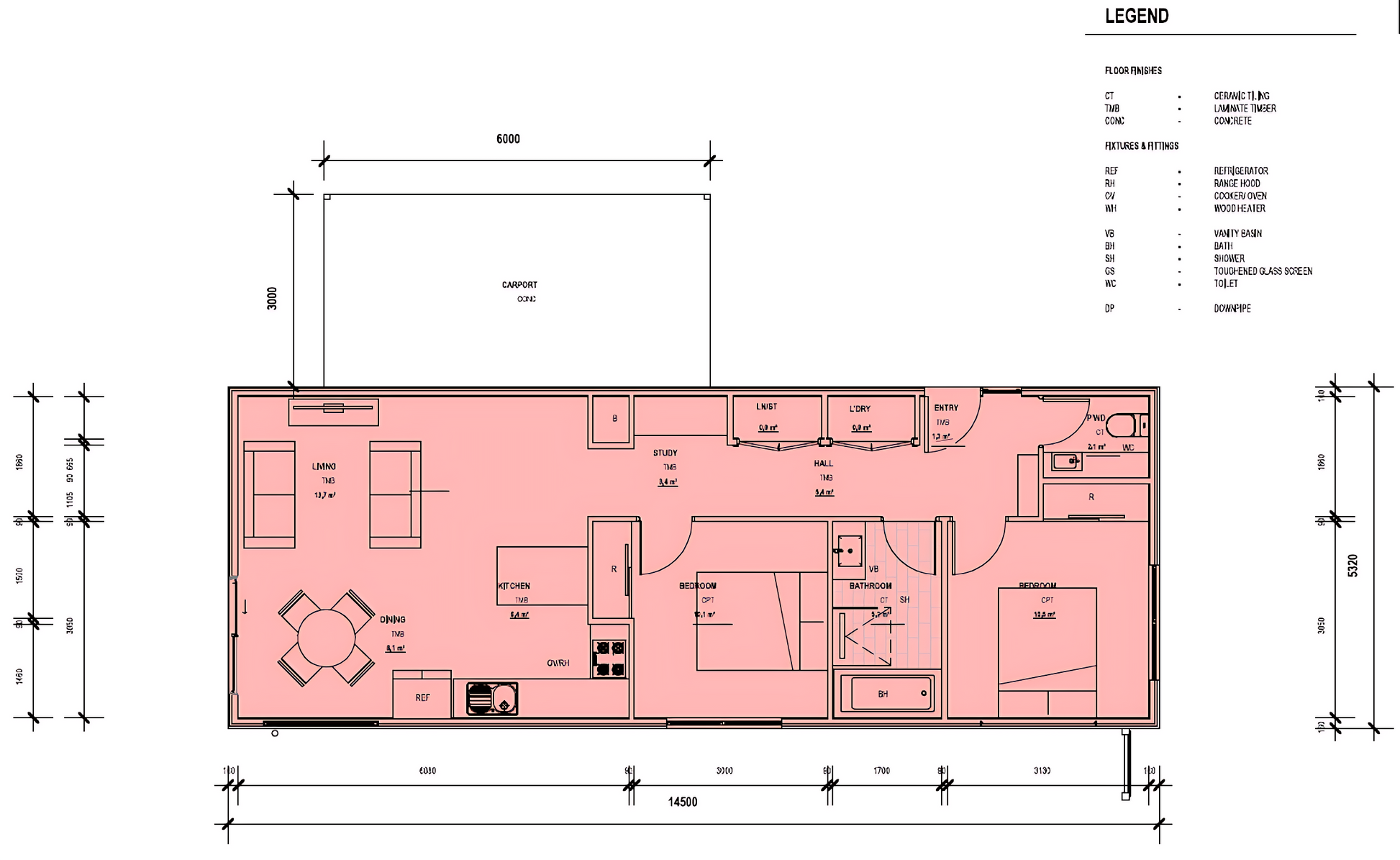

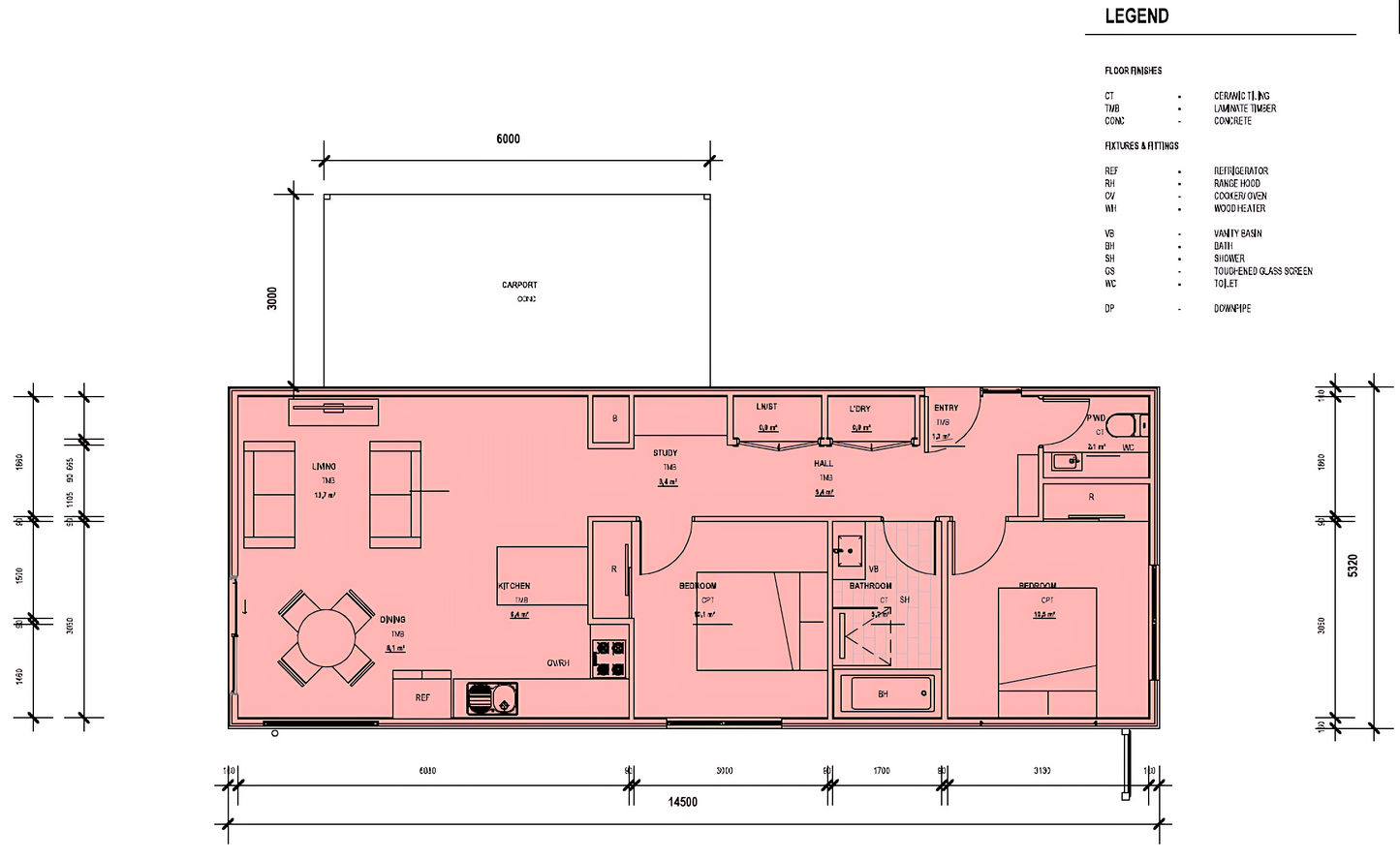

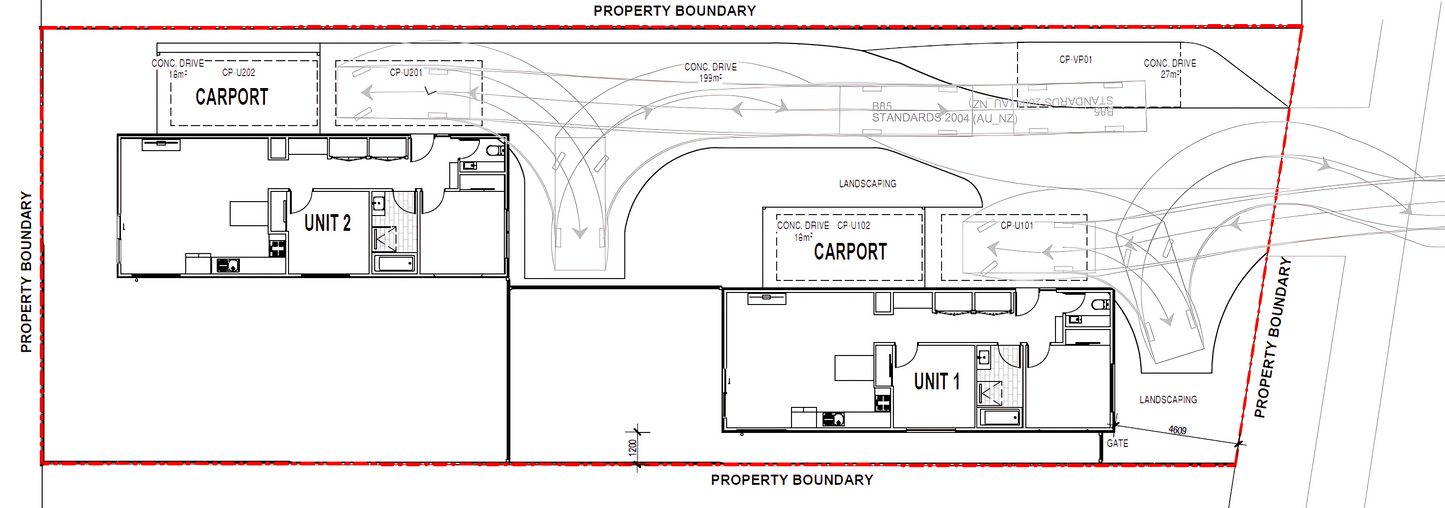

Configuration: 2 x 2 Bed, 1 Bath, separate WC, open-plan living, study area, 1 Carport per villa

Rental appraisal: $900 per week combined ($450 per villa) - $46,659 p.a.

Gross rental yield: 7.2%

10-year average annual capital growth (area): 10.14%

Location & Growth Drivers

New Norfolk is a Derwent Valley hub about 35 minutes from Hobart, combining riverside lifestyle with practical access via the Lyell Highway. Liveability scorecards indicate strong tranquility and community engagement, with everyday retail anchored by Woolworths and a growing food and distillery scene. The rental pool includes commuters, key workers and local service employees seeking affordable homes within reach of Hobart.

Market indicators show healthy tenant demand relative to supply, with competitive leasing conditions for well-presented turnkey dwellings. Investors participate in the region’s affordability-led growth while targeting steady occupancy and respectable yields.

Build Specification (Turnkey)

- Land size ~809 m²; Anticipated land registration: November 2025.

- Total building area ~190.2 m² (each villa ~95.1 m² plus carport), single-storey residential construction.

- Custom facade, Colorbond roof, cladding to front elevation per specification.

- Aluminium double-glazed windows, roller blinds to windows and sliders (ex. wet areas and garage).

- Floating floors to living, carpet to bedrooms, tiled wet areas; stone benchtops; 600 mm appliances; dishwasher.

- Electric reverse-cycle heat pump, 250 L electric hot water; insulation to energy report; LED lighting and smoke alarms.

Why This Deal Stacks Up

- Dual income on one title - two self-contained villas diversify tenancy and support steady cash flow.

- Turnkey simplicity - comprehensive inclusions compress time-to-rent and reduce variation risk.

- Demand depth - proximity to Hobart with strong community amenity underpins occupancy.

- Yield profile - 7.2% headline yield compares favourably to broader suburb averages for standard stock.

- Growth participation - investors gain exposure to an area with an 10.14% 10-year average annual growth benchmark.

Risks & Mitigations

- Interest-rate sensitivity - serviceability depends on debt costs at 80% LVR. Mitigation: target top-band rent, consider IO periods or sharper pricing, and review PM fees annually.

- Build and title timing - registration anticipated November 2025 and construction timelines can move. Mitigation: fixed-price inclusions, milestone tracking and contingency buffers.

- Leasing variance - achieved rent may fluctuate around $900 per week combined. Mitigation: professional marketing, premium presentation and refresh at renewal.

- Operating cost drift - insurance, maintenance and rates can step up. Mitigation: preventative maintenance and competitive re-quotes each year.