“New Norfolk Dual-Villa Investment – $46,659 Income, 7.2% Yield, 2 × 2-Bed Villas”

Property analysis by:

Investment Highlights

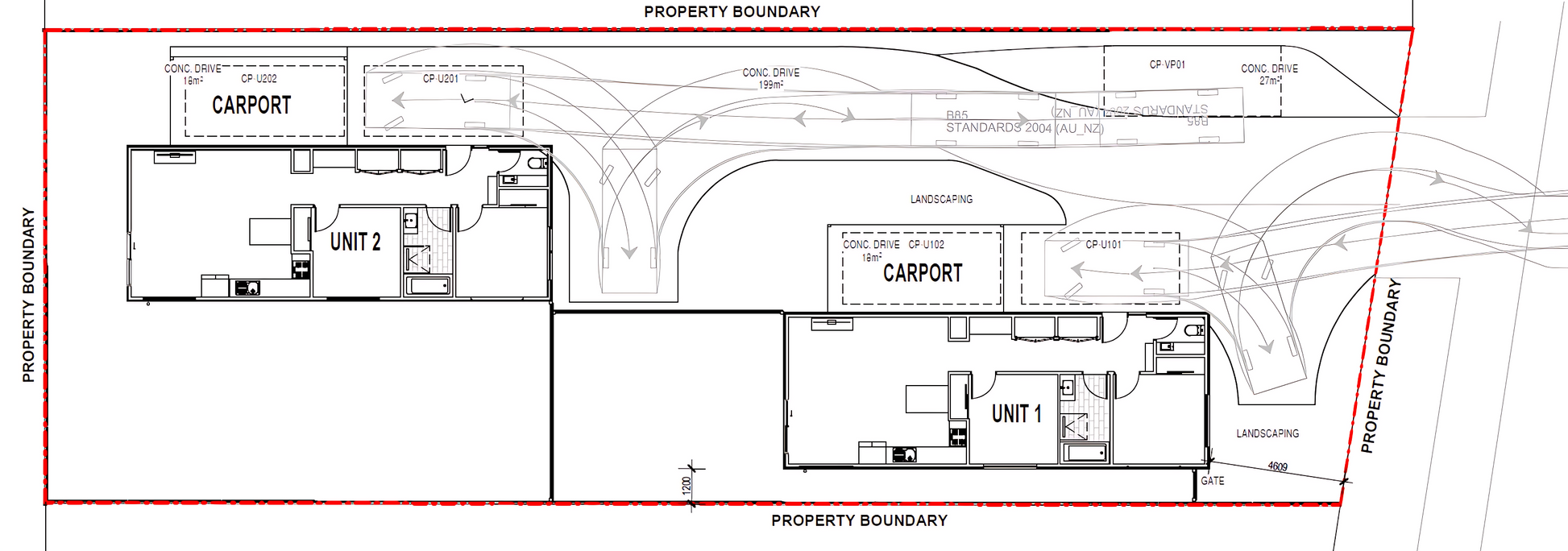

- Priced at $650,000 for a dual-villa package configured as 2 × 2-bed, 1-bath, 1-carport villas on one title.

- Rental guidance $900 per week combined (typically ~$450 per villa) → $46,659.60 p.a.

- Headline gross yield 7.2% on the package price; attractive for a standard residential tenancy model.

- Vacancy context extremely tight at ~0.30%, supporting leasing confidence and steady occupancy.

- Growth participation 10-year average annual capital growth benchmark 10.14% (~$65,910 on package price).

- Turnkey delivery with modern inclusions, separate living zones, study nook and on-title carport plus extra car space for each villa.

- Hobart adjacency ~35 minutes via Lyell Highway; riverside lifestyle and strong community amenities in New Norfolk.

Key Financials

Property package price: $650,000 (Land $200,000 + Build $450,000)

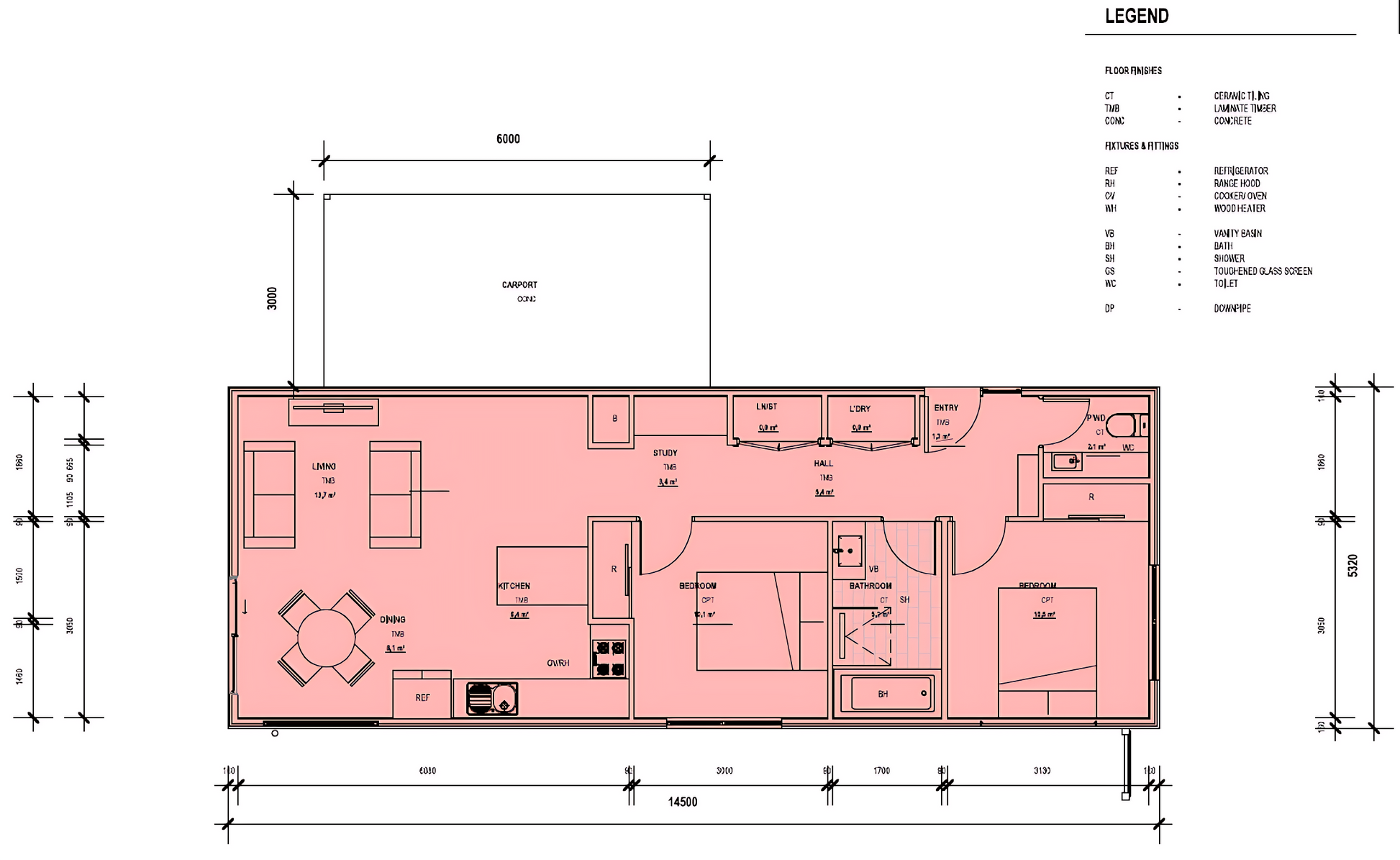

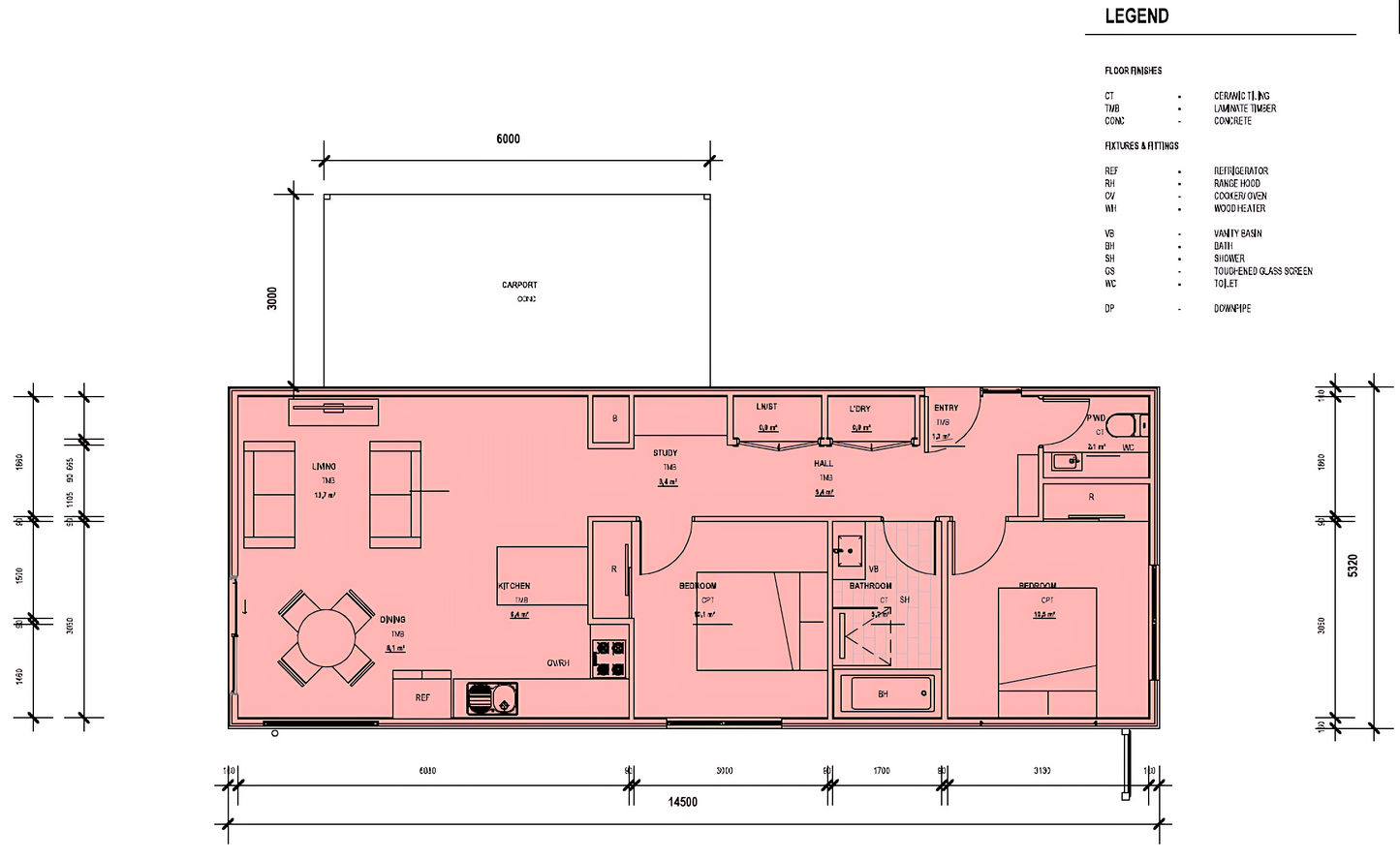

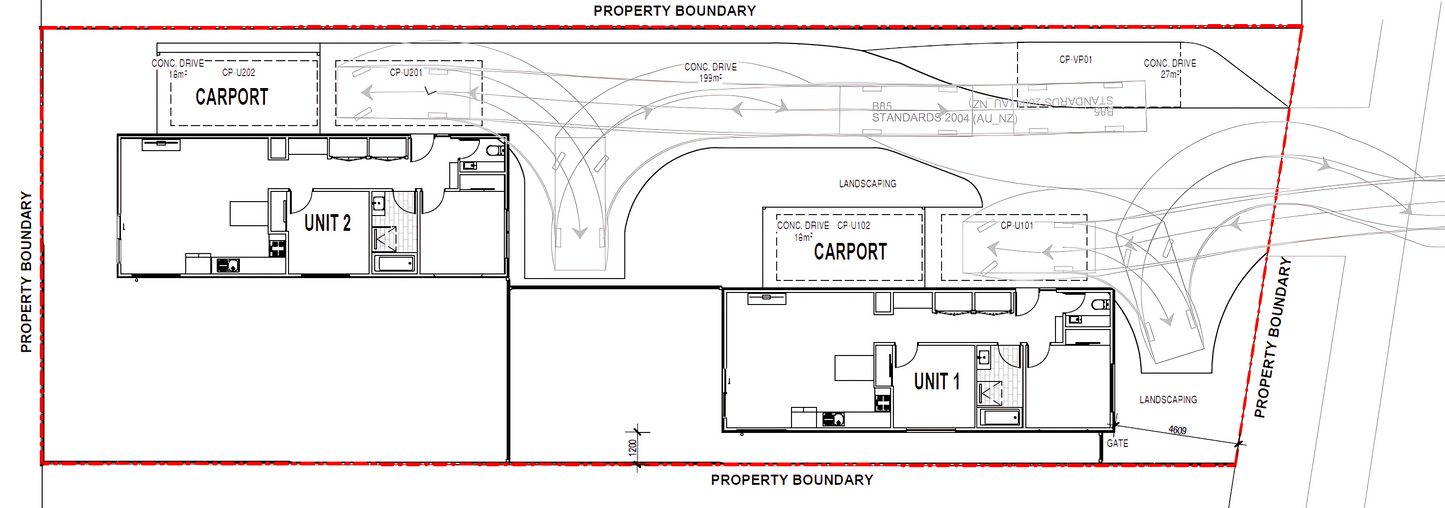

Configuration: 2 × 2 Bed, 1 Bath (separate WC), open-plan living + study, 1 Carport + 1 extra car space each

Sizes: Total building ~190.2 m² (≈95.1 m² per villa) • Land ~749 m²

Rental appraisal: $900 per week combined → $46,659.60 p.a.

Gross rental yield: 7.2%

Vacancy rate (guide): ~0.30%

10-year avg. annual capital growth (area): 10.14% (~$65,910 illustrative annual uplift on package price)

Status: Anticipated land registration: November 2025

Location & Growth Drivers

New Norfolk anchors the Derwent Valley ~35 minutes from Hobart, combining riverside lifestyle with practical access via the Lyell Highway. Everyday amenity includes supermarkets, health services, schools (primary and high), and an emerging food/distillery scene. Lifestyle scorecards indicate above-average tranquility and strong community engagement, supporting stable family and downsizer demand.

Dual-villa stock addresses affordability and household flexibility (couples, small families, and key workers), broadening the tenant pool and supporting year-round occupancy at the $450-per-villa price point.

Build Specification (Turnkey)

- Single-storey construction; custom facade; Colorbond roof; cladding to front elevation (per spec and approvals).

- Aluminium double-glazed windows; roller blinds to windows/sliders (ex. wet areas/garage).

- Floating floors to living/kitchen/halls; carpet to bedrooms; tiled wet areas.

- Kitchen with stone benchtops and 600 mm appliances; dishwasher; laundry cabinetry.

- Electric reverse-cycle heat pump; 250 L electric hot water; insulation per energy report.

- LED lighting, smoke alarms; NBN provision; driveway, paths, fencing and landscaping per plans.

Why This Deal Stacks Up

- Dual income on one title: two self-contained villas diversify tenancy and help smooth vacancy risk.

- Yield edge with low vacancy: 7.2% headline yield in a ~0.30% vacancy market supports quicker lease-up and renewal strength.

- Turnkey certainty: comprehensive inclusions reduce variation risk and compress time-to-rent on completion.

- Hobart-linked demand: commuting access + lifestyle amenity attract consistent renter cohorts.

- Growth participation: exposure to a market with a 10.14% 10-yr average annual growth benchmark.

Risks & Mitigations

- Build/title timing: registration targeted for Nov 2025; timelines can shift. Mitigation: fixed-price inclusions, milestone tracking, and holding-cost buffers.

- Leasing variance: achieved rent may fluctuate around $900/wk combined. Mitigation: professional marketing, premium presentation, and strong renewal cadence.

- Operating cost drift: insurance/rates/maintenance may step up. Mitigation: preventative maintenance and annual re-quotes.

- Rate sensitivity: cashflow depends on funding costs. Mitigation: consider IO periods/competitive repricing; maintain prudent cash buffers.