“New Norfolk House & Land – $33.6k Income, 5.6% Yield, Riverside Growth Near Hobart”

Property analysis by:

Investment Highlights

- Priced at $599,000 (Land $200,000 + Build $399,000) with rental income of $33,698 p.a. — delivering a 5.6% gross yield on completion.

- Low vacancy setting: suburb vacancy around 0.3%, supporting tenanting confidence.

- Growth participation: 10-year average annual capital growth benchmark of ~8.3% for the area.

- Family-ready turnkey: full house-and-land package with modern inclusions; no furniture package required for standard leasing.

- Connectivity + lifestyle: ~35 minutes to Hobart via Lyell Hwy, riverside recreation on the Derwent, strong community amenities.

Key Financials

Purchase price: $599,000 (Land $200,000 + Build $399,000)

Configuration: 4 Bedrooms, 2 Bathrooms, 1 Car (single-storey, full turnkey)

Rental appraisal: $650 per week ($33,698 p.a.)

Gross yield: 5.6%

Vacancy rate (guide): 0.30%

Cashflow (before tax): -$88.70/wk on feasibility settings

Location & Growth Drivers

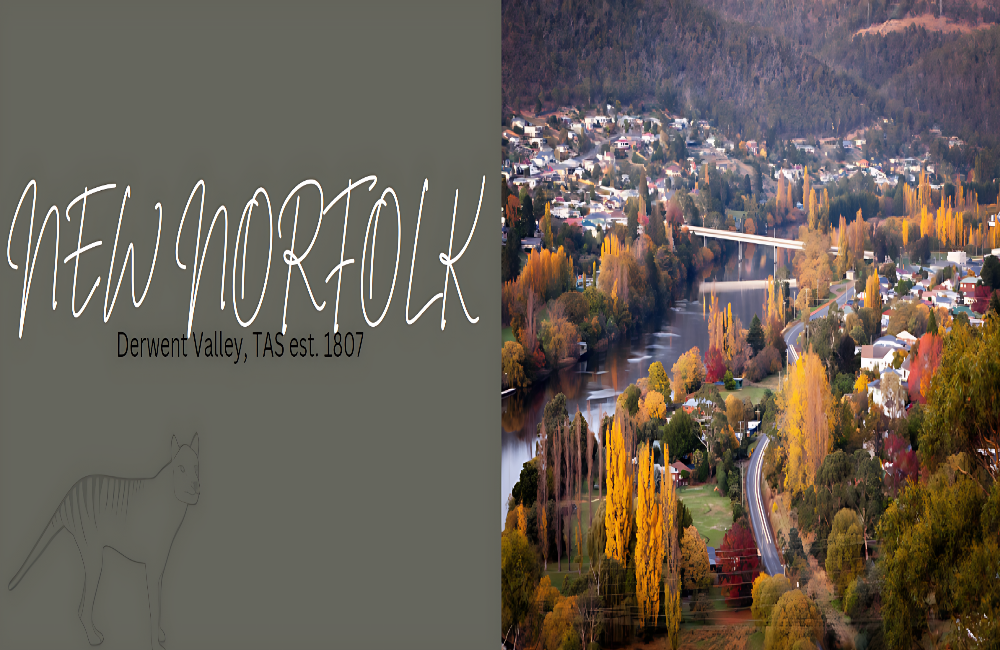

New Norfolk is a Derwent Valley hub ~35 minutes from Hobart, offering riverside living, heritage charm, and practical access via the Lyell Highway. Lifestyle scorecards indicate above-average tranquility and strong community engagement, with local markets, parks, and sporting facilities. Families benefit from multiple primary schools and New Norfolk High School, plus healthcare (GP clinics, pharmacies, health hub) and everyday retail anchored by Woolworths. The rental pool is supported by commuters, key workers, and local service employees seeking affordable family homes within reach of Hobart.

Market indicators show healthy tenant demand relative to supply, with low vacancy levels and competitive leasing conditions for well-presented turnkey houses. Investors participate in the region’s affordability-led growth narrative while targeting steady occupancy and respectable yields.

Build Specification (Turnkey)

- Single-storey dwelling, ~148.3 m² building size on ~757 m² land (Anticipated land registration: November 2025).

- Custom facade, Colorbond roof, cladding to front elevation (per specification and approvals).

- Aluminium double-glazed windows, roller blinds to windows and sliders (ex. wet areas/garage).

- Floating floors to living/dining/kitchen/halls; carpet to bedrooms; tiled wet areas.

- 600 mm oven and cooktop, rangehood, dishwasher; stone benchtops; laundry cabinetry.

- Electric reverse-cycle heat pump; 250 L electric hot water; insulation to energy report.

- LED lighting, smoke alarms; NBN-ready; driveway and fencing as per plans; remote garage door.

- External/internal painting, skirtings/architraves; wardrobes with shelving and hanging rails.

Why This Deal Stacks Up

- Reliable demand drivers: Affordable family housing close to Hobart, with riverside lifestyle and strong community amenities that attract long-term renters.

- Turnkey delivery: Comprehensive inclusions compress time-to-income, reduce variations, and simplify the handover to property management.

- Low vacancy context: ~0.3% vacancy supports shorter leasing periods and durable occupancy for standard 4-bed homes.

- Growth participation: Exposure to an area with ~8.3% 10-year average annual capital growth benchmark, while retaining rental affordability.

- Serviceability clarity: Clean, standard tenancy (no specialised licensing), straightforward to finance and manage versus niche strategies.

Risks & Mitigations

- Interest-rate sensitivity: Base feasibility is slightly negative at 6.0%. Mitigation: Target top-of-range rent ($650/wk), negotiate PM fees/utilities, consider interest-only periods or sharper debt pricing.

- Build and title timing: Registration anticipated November 2025; build timelines can shift. Mitigation: Fixed-price inclusions, milestone tracking, and contingency buffers.

- Leasing variance: Achieved rent may fluctuate within the $630–$650 band. Mitigation: Present turnkey quality, professional marketing, and refresh at renewal to defend top-band rents.

- OPEX drift: Insurance, maintenance, and council rates can step up. Mitigation: Annual reviews, preventative maintenance, and competitive re-quotes.