“Jackass Flat Co-Living Investment – $57k Income, 8.5% Yield, +$142/wk Positive Gearing”

Property analysis by:

Investment Highlights

- Priced at $674,000 with rental income of $57,315 p.a. – delivering a strong 8.5% gross yield.

- Cashflow-positive: estimated surplus of +$142.38 per week before tax under current assumptions.

- Purpose-built co-living design: 3 self-contained ensuites plus additional bedrooms and shared spaces for multiple income streams.

- Ultra-low vacancy: just 0.7% in Jackass Flat, Bendigo ensuring tenant demand remains consistently high.

- Population boom: suburb has grown 72.9% over the past 5 years – one of the fastest growth rates in Victoria.

Key Financials

Purchase price: $674,000 (Land + Build)

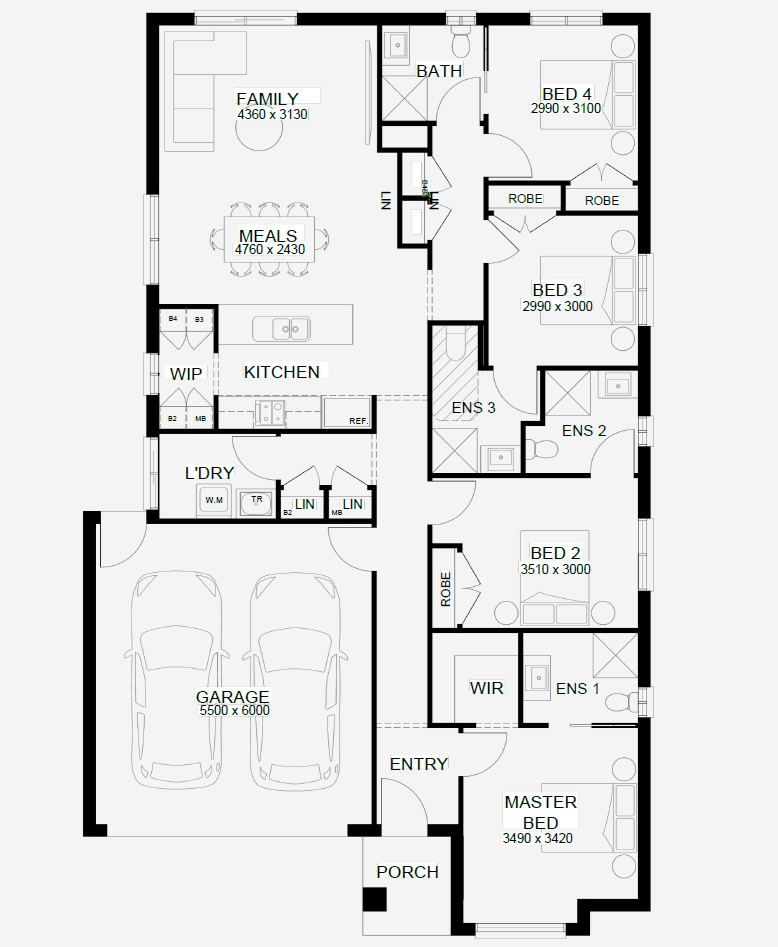

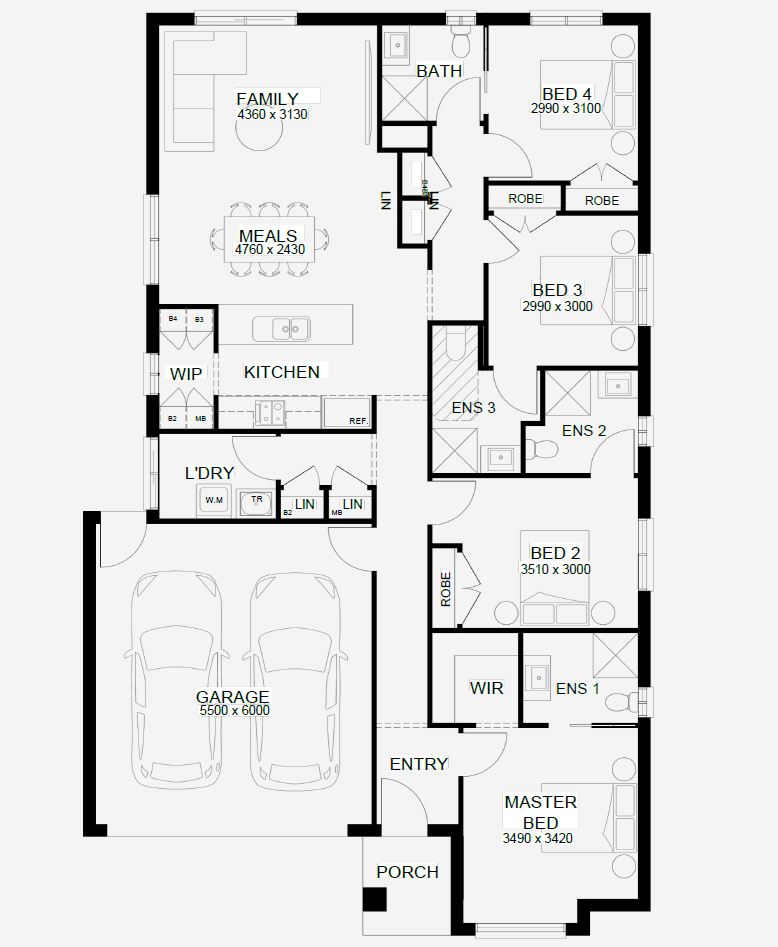

Configuration: 4 Bedrooms, 4 Bathrooms, 2 Cars (Co-Living 1A compliant)

Land price: $270,000

Build price: $404,000

Rental appraisal: $1,110 per week (~$57,315 p.a.)

Gross yield: 8.5%

Vacancy rate: 0.7%

10-year avg. annual growth: 9.71%

Cashflow: +$7403.53 p.a. (~+$142.38 per week) before tax

Location & Growth Drivers

Jackass Flat is a thriving suburb within Greater Bendigo, located just 4 km from the city centre. The suburb blends natural tranquility with convenient access to Eaglehawk Road, Canterbury Park, and local shopping strips. Families are drawn by parks, low-traffic streets, and above-average safety, while professionals and students value the direct connectivity into Bendigo CBD.

The suburb’s fundamentals are exceptionally strong: 72.9% population growth in 5 years, a $594,000 median house price with 4.6% rental yield, and extremely low vacancies. Lifestyle scores rank highly for tranquility (82/100) and community engagement, making Jackass Flat both liveable and investable. Development pipelines further support ongoing demand and long-term value uplift.

Build Specification (Co-Living)

- Specialist Co-Living 1A compliant design for multiple tenancies

- 4 bedrooms including 3 self-contained ensuites

- Modern kitchen, hybrid flooring, tiled wet areas, and keyless digital locks

- Energy-efficient build with NBN, air-conditioning in each bedroom and living area

Why This Deal Stacks Up

- Cashflow-positive in year one: Rare in today’s market, with +$142.38/week pre-tax.

- High yield strategy: 8.5% gross yield versus Bendigo’s median 4.3% yield.

- Population surge: 72.9% growth ensures strong tenant pipeline and future buyer demand.

- Low-risk tenancy model: multiple rooms/ensuites spread risk across diversified income streams.

Risks & Mitigations

- Specialised management: Co-living requires experienced property managers. Mitigated by engaging specialists who understand multi-tenant compliance.

- Market cycle: Jackass Flat saw -2.78% 1-year growth, but long-term demand underpinned by affordability and demographics.

- Higher tenant turnover: Room-based leasing increases movement. Diversified tenancy reduces overall vacancy risk.

- Financing: Some lenders may require additional due diligence for co-living. Strong cashflow and yield mitigate finance risk.