“Tin Can Bay Dual-Key Investment – $53.7k Income, 6.6% Yield, Coastal Growth Hub”

Property analysis by:

Investment Highlights

- Priced at $818,938 with appraised rental income of $53,701 p.a. – delivering a strong 6.6% gross yield.

- Dual-key configuration: two self-contained dwellings for diversified income streams.

- Coastal lifestyle location: minutes from Tin Can Bay Marina, foreshore cafes, and the world-renowned dolphin-feeding precinct.

- High tranquility & community score: peaceful bay setting with strong local engagement and ongoing infrastructure improvements.

Key Financials

Purchase price: $818,938 (Land + Build)

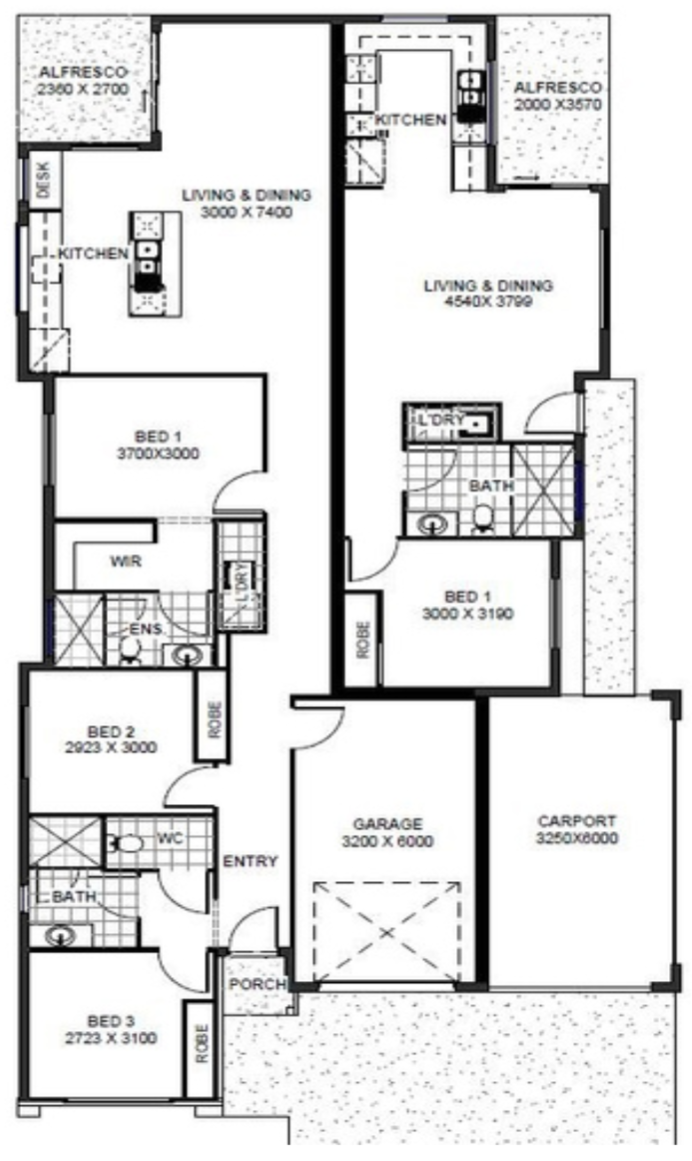

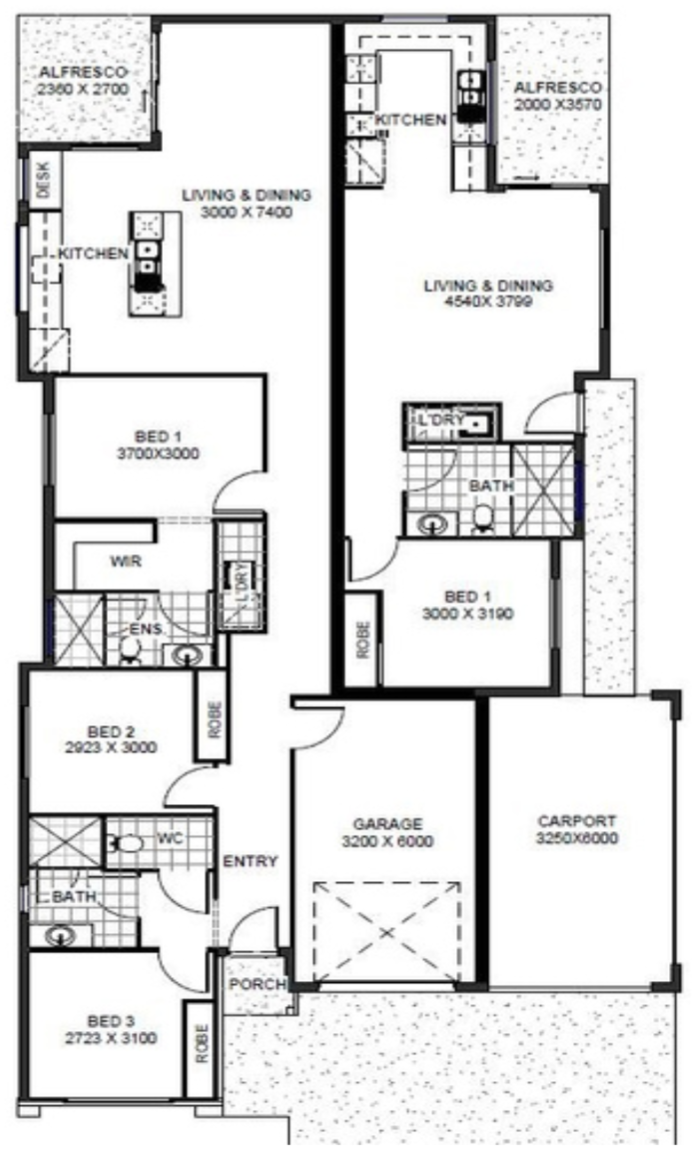

Configuration: Dual-key – 3 Bed + 1 Bed (2 units)

Land size: 391 m² | Build size: 132.37 m² + 85.31 m²

Land price: $300,000 | Build price: $518,938

Rental appraisal: 1,040 per week (~$53,701 p.a.)

Gross yield: 6.6%

10-year avg. annual growth: 8.4%

Vacancy rate: 0.7%

Cashflow: +$2,683 p.a. ($51.6 per week)

Location & Growth Drivers

Tin Can Bay, a serene coastal township on Queensland’s Fraser Coast, offers a rare blend of natural beauty and steady infrastructure growth. The suburb’s proximity to Rainbow Beach, Gympie, and the Great Sandy Strait positions it as a lifestyle-driven yet high-yielding investment pocket.

Lifestyle metrics are strong: high tranquility scores, very strong community cohesion, and consistent local tourism activity. With increasing relocations from Brisbane and the Sunshine Coast seeking affordability and serenity, Tin Can Bay’s property demand has risen notably over the past five years. Development of new retail hubs and improved transport connectivity further underpin its investment appeal.

Build Specification (Dual-Key)

- Fully turnkey package with 7-star energy efficiency

- AAC Hebel render construction (superior thermal and acoustic performance)

- Split A/C units to all master bedrooms and living areas

- Stone benchtops to kitchens, Bellissimo LED appliances, and remote garage doors

- Full landscaping, fencing, and driveways included in price

- 12-month maintenance period and high-quality Colorbond roofing

- Fully independent utilities with dual water meters and electrical metering

Why This Deal Stacks Up

- Diversified income: two tenancies under one roof, reducing vacancy risk and improving rental stability.

- Coastal growth corridor: Tin Can Bay is part of the Gympie LGA, one of Queensland’s fastest-growing regional coastal zones.

- Cashflow and capital growth: 6.6% yield paired with 8.4% 10-year average growth rate.

- High livability: strong community ties, safe family environment, and increasing infrastructure investment.

- Low vacancy & secure leasing: sub-1% vacancy across comparable properties ensures reliable occupancy.

Risks & Mitigations

- Regional location risk: mitigated by Tin Can Bay’s rising migration trend and dual-income structure.

- Tenant turnover: offset through two self-contained dwellings providing flexibility for long-term leases.

- Financing considerations: lenders may have stricter criteria for dual-key homes, but strong yields support serviceability.

- Limited secondary education facilities: nearby Gympie schools and transport access reduce practical impact.