“Lara Family Home Investment – $28.34k Income, 4.5% Yield, Turnkey Near Geelong & Rail”

Property analysis by:

Investment Highlights

- Priced at $631,000 (full turnkey house & land) delivering dependable family-home demand in Lara.

- Rental guidance $550 per week → $28,342.60 p.a. at current settings.

- Gross yield 4.5% on package price; positioned in a suburb with strong convenience and fast rail/road access to Geelong & Melbourne.

- Turnkey + 7★ energy rating: high ceilings (2740 mm), 2340 mm doors, ducted heating & cooling, landscaping, blinds, stone, driveway—ready to lease.

- Area momentum: 10-yr average annual capital growth benchmark of 5.20% (~$32,812 on the package price).

Key Financials

Property package price: $631,000

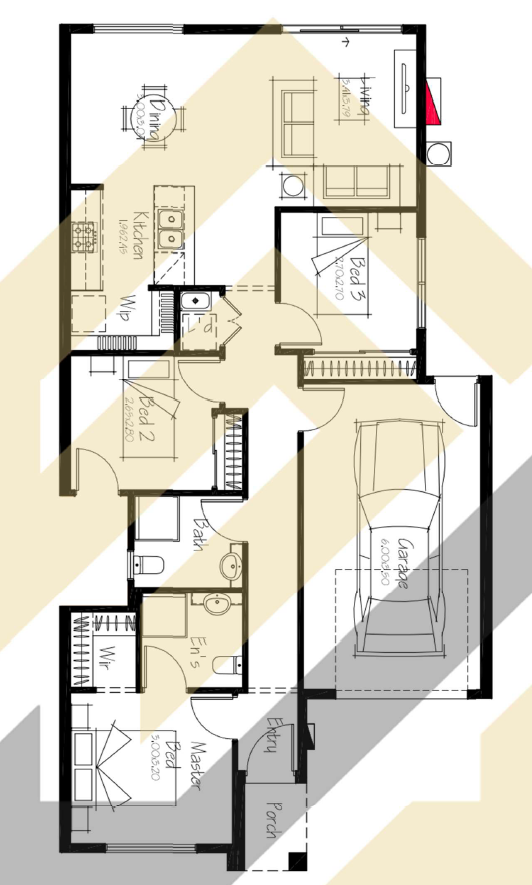

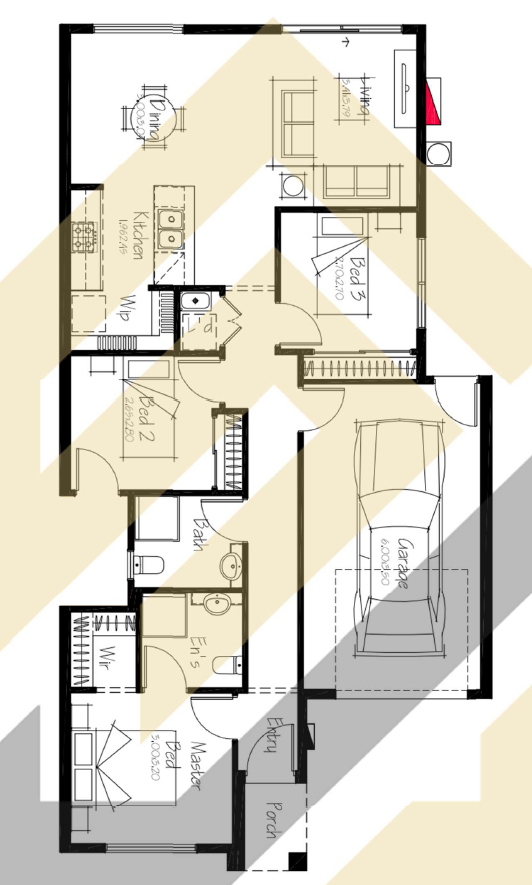

Configuration: 4 Bedrooms, 2 Bathrooms, 1 Car (single garage) • House ~14.5 sq (≈135 m²) on ~266 m² lot • Titled

Rental appraisal: $550 per week → $28,342.60 p.a. (provided)

Gross rental yield: 4.5%

10-year average annual capital growth (area): 5.20% (~$32,812 p.a. illustrative uplift on package price)

Location & Growth Drivers

Lara sits between Melbourne and Geelong with direct access to the Princes Freeway and Lara Train Station. Convenience is above average (rail, supermarkets, cafés and everyday retail), with high tranquility driven by leafy streets and proximity to Serendip Sanctuary and green corridors. Family appeal is strong thanks to schools (incl. Lara Secondary College), sports clubs and community hubs. For renters, the address offers practical commuting plus lifestyle value—supporting steady demand for modern 4-bed houses.

Market indicators show healthy absorption and competitive leasing for well-presented family stock. This package targets durable occupancy from family and key-worker cohorts who prioritise space, comfort, and connectivity to Geelong employment and Melbourne via rail/road.

Build Specification (Turnkey)

- Energy & comfort: 7-Star energy rating, 2740 mm ceilings, 2340 mm internal & external doors, heating & cooling.

- Kitchen & finishes: stone benchtops throughout, dishwasher, stainless appliances.

- Flooring & window coverings: full floor coverings and Holland blinds included.

- External works: driveway, letterbox, clothesline, front & rear landscaping.

- Connectivity & security: NBN provision, locks to windows, LED lighting.

- Status: Titled land—streamlines build commencement and time-to-rent.

Why This Deal Stacks Up

- Family tenant depth: 4-bed layout hits the broadest rental audience in Lara—families and sharers—supporting stable occupancy.

- Turnkey certainty: comprehensive inclusions and titled land compress time-to-income and reduce variation risk.

- Connectivity premium: fast rail to Melbourne and easy access to Geelong employment hubs underpin durable rental demand.

- Capital growth participation: ~5.20% 10-yr benchmark offers long-run compounding alongside solid day-one yield.

- Spec-led appeal: 7★ energy rating, higher ceilings and quality finishes support stronger inspections and tenant retention.

Risks & Mitigations

- Interest-rate sensitivity: Cashflow depends on funding costs. Mitigation: target top-band rents, consider IO periods/competitive repricing, annual PM-fee review.

- Leasing variance: Achieved rent may fluctuate around $550/wk. Mitigation: premium presentation, professional marketing, and strong renewal strategy.

- Operating cost drift: Insurance, rates and maintenance can lift. Mitigation: preventative maintenance and annual re-quotes across major line items.

- Market cycle: Price growth can slow cyclically. Mitigation: focus on quality spec, connectivity, and family-sized layouts that outperform in softer periods.