“Jackass Flat SMSF Rooming House – $57.3k Income, 7.2% Yield, +$184/wk Positive Gearing”

Property analysis by:

Investment Highlights

- Priced at $674,000 + $121,320 SMSF conversion, with projected rental income of $57,316 p.a. delivering an impressive 7.2% gross yield.

- Cashflow-positive: +$184 per week pre-tax surplus under current assumptions.

- SMSF-suited: one-part contract, depreciation allowances, and specialist rooming design ideal for self-managed super funds.

- Ultra-low vacancy: just 0.7% in Jackass Flat, ensuring reliable tenancy demand.

- Population surge: 72.9% growth in the past 5 years – one of the fastest-growing suburbs in Victoria.

Key Financials

Purchase price: $674,000 + $121,320 SMSF conversion (Land + Build)

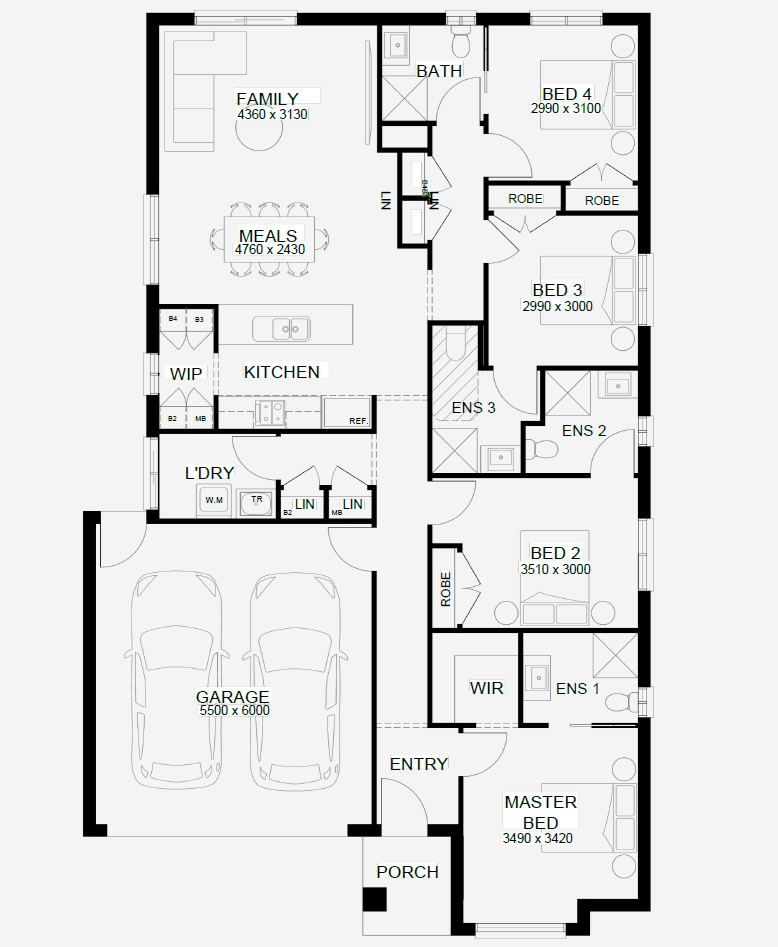

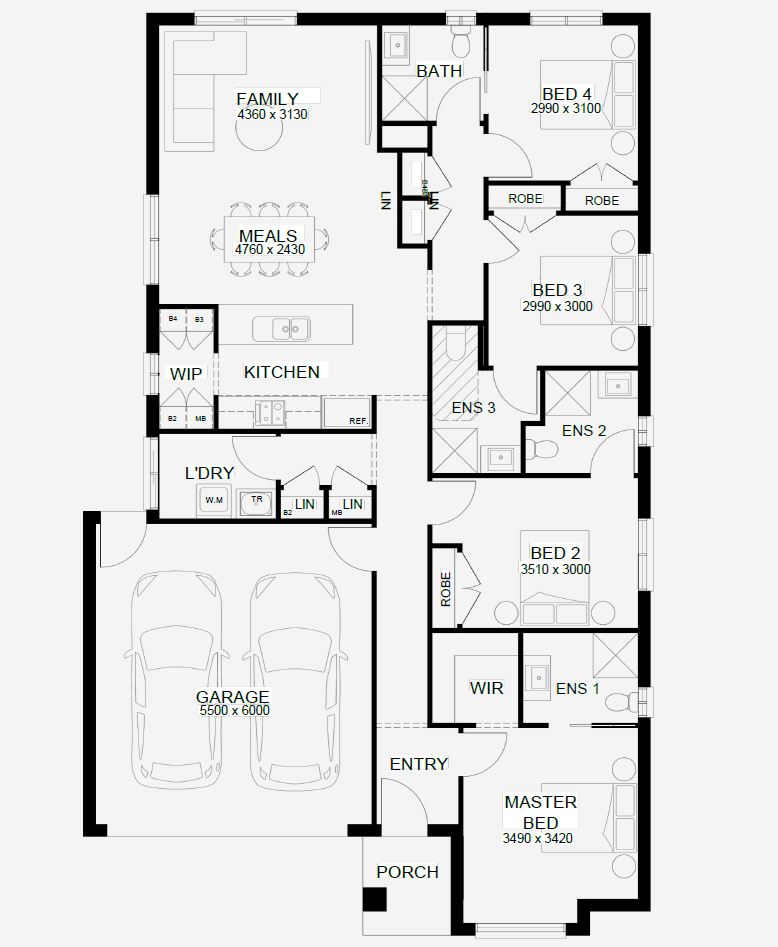

Configuration: 4 Bedrooms, 4 Bathrooms, 2 Cars (rooming layout: 3 ensuites + 1 additional bedroom)

Land size: 564 m²

Build price: $404,000 | Land price: $270,000

Furniture package: $22,000

Rental appraisal: $1,110 per week (~$57,315 p.a.)

Gross yield: 7.2%

Vacancy rate: 0.7%

10-year avg. annual growth: 4.8%

Cashflow: +$9,570 p.a. (~+$184 per week) before tax

Cash-on-cash return: 3%

Location & Growth Drivers

Jackass Flat, located 4 km from Bendigo CBD, blends suburban tranquility with access to major lifestyle and employment hubs. The suburb enjoys proximity to Eaglehawk Road, Canterbury Park, and local shopping strips, alongside reliable bus connections into Bendigo.

Lifestyle indicators are strong: tranquility (82/100), family appeal, and a very strong community rating. The area has experienced an extraordinary 72.9% population growth in just 5 years, with vacancy rates at 0.7% supporting long-term rental demand. Development pipelines and Bendigo’s expansion further secure future tenant supply and capital appreciation.

Build Specification (SMSF Rooming House)

- Specialist SMSF-ready Rooming House configuration

- 4 bedrooms including 3 ensuites + 1 additional bedroom

- 4 modern bathrooms, 2 secure car spaces

- Energy-efficient inclusions: split-system air-conditioning, LED lighting, and low-maintenance design

- Compliance with rooming standards and fire safety

Why This Deal Stacks Up

- High-yield SMSF strategy: 7.2% gross yield and +$184/week surplus outperform typical residential assets.

- Tenant demand security: vacancy at 0.7% and diversified tenancy through rooming structure.

- Population-led growth: suburb’s 72.9% growth rate drives ongoing housing demand.

- SMSF suitability: one-part contract, depreciation, and consistent cashflow align with SMSF portfolio goals.

- Growth & stability: 10-year average capital growth of 4.80% combines with reliable income.

Risks & Mitigations

- Specialised management: Rooming houses require experienced property managers. Mitigated by engaging SMSF-focused co-living managers.

- Tenant turnover: Higher movement in rooming houses. Mitigated by multiple income streams and consistently high demand.

- Market cycle: Jackass Flat recorded -2.78% 1-year growth, but long-term growth underpinned by affordability and demographics.

- Financing complexity: SMSF lending can be stricter; mitigated by strong cashflow and yield exceeding lender stress test levels.